About Us

About Us

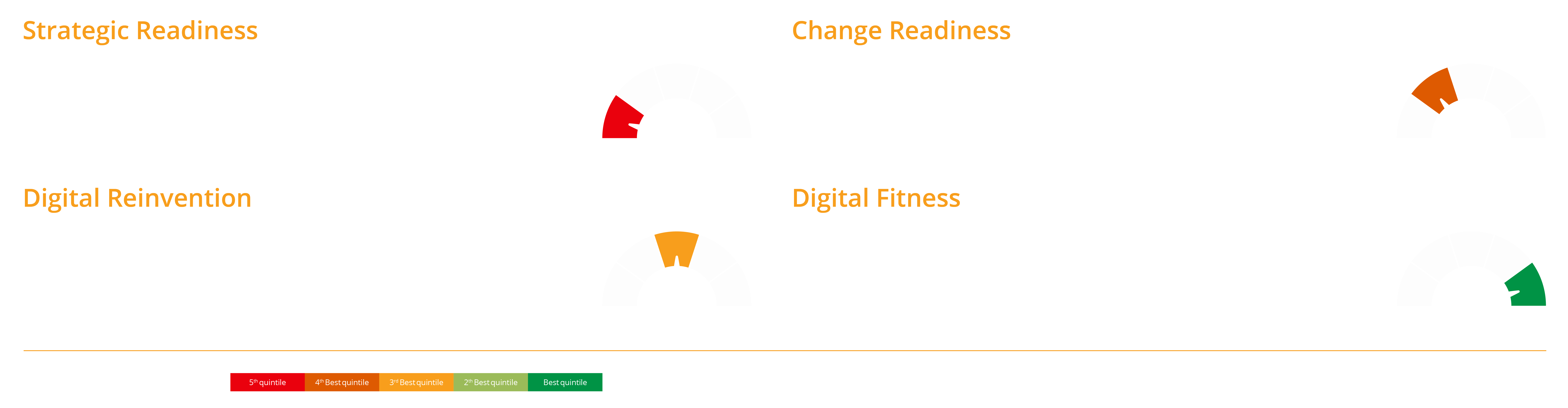

We help companies to reinvent customer value creation and delivery through digital reinvention in a Low-Touch economy.

LEARN MORE

At VCL, we’re dedicated to guiding you through this advanced phase of digital transformation. Consider us not just consultants, but collaborative partners and architects of your digital growth, sparking new ideas and paving the way for your transformative journey.

Confronting contemporary obstacles requires ingenious resolutions. At VCL, our team of strategists, data scientists, enterprise architects, and leadership coaches work hand in hand to tackle our clients’ most pressing issues, transforming their phygital journey.