Banking

Implement Big Data Solutions, increase the availability and transparency of services and reduce the need of human intervention.

Introduction

Is the banking industry in the Middle East ready to overcome the challenges of the COVID-19 pandemic? The Banking sector is going through a massive transformation phase.

The Banking sector in the Middle East is one of the world’s fastest growing markets. Banks across the region are investing heavily to match or outperform their international competitors. Changes in consumer behaviors, digitization and emerging technologies has increased the complexity of the banking industry, the demand for realtime interaction and the need for better experiences across channels.

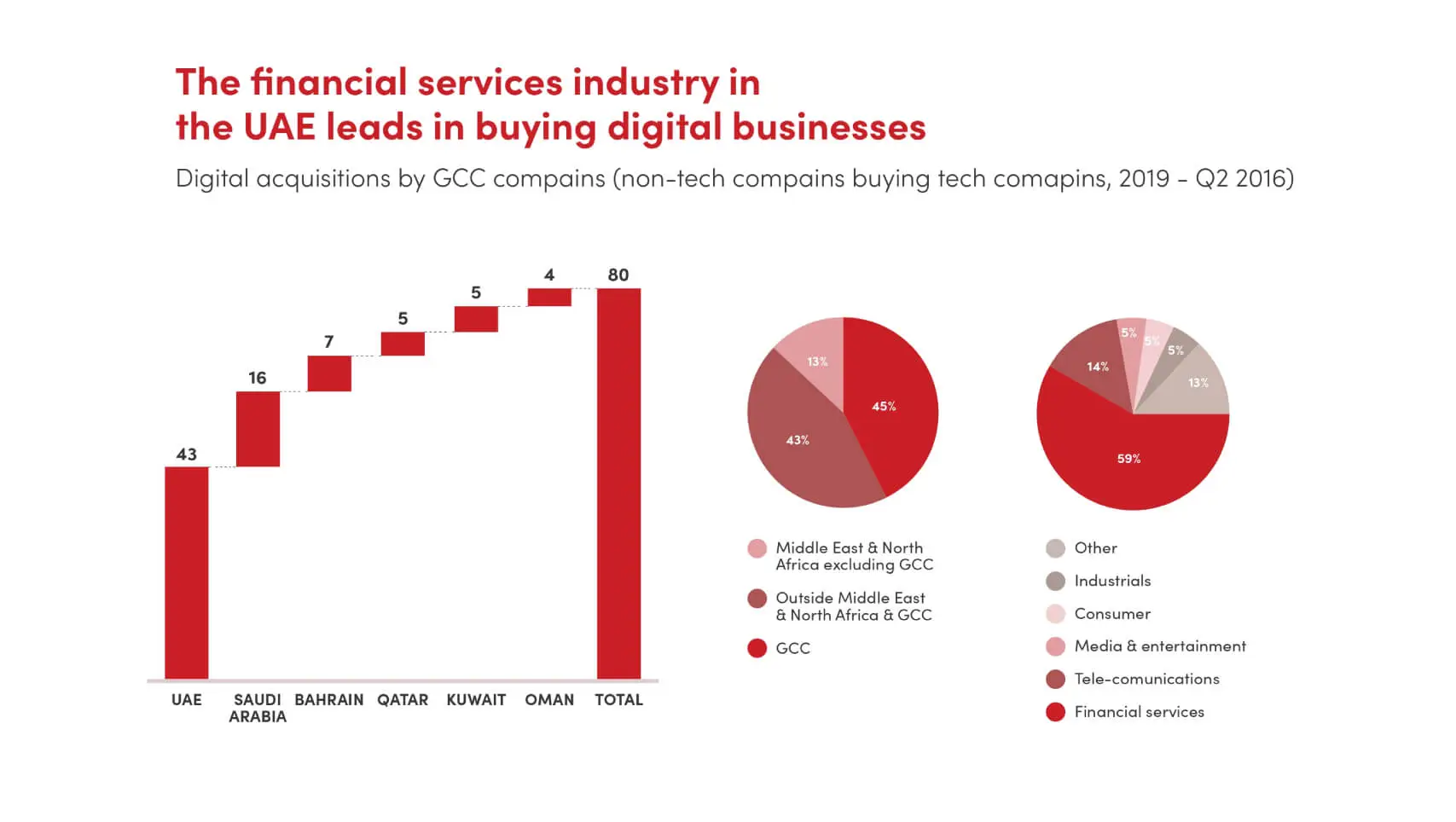

Governments in the Middle East pushed for Digital Transformation in the banking sector during services entities to acquire and invest in the technology business.

Source: Zawya Thomson Reuters; Strategy & Analysis,

From: Preparing for the digital era: The state of digitalization in GCC businesses, 2016

Key Challenges in Banking Sector

Price Transparency for Products

Customers in the banking sector are getting confused with the actual costs of transactions. While bank staff is usually aware of the tariffs and cost structures, they are not aware of other fees such as external transfers. This leads many customers to consider banking with another institute which has more transparency in cost structures.

Unpredictable Availability of Infrastructural Recourses

Due to lockdowns, the lack of availability of physical infrastructural resources, such as physical branches or call center operating equipment, will hinder the quality of customer service and may increase the retrieval time of certain information massively.

Waiting Time of Call Centers

As the physical branches might not be available due to lockdowns, there will be a huge increase in the dependency on call centers, which may not be prepared to handle the increase in the volume of received calls and requests. Additionally, if there is an actual physical location of the call center, it might be contaminated and forced into closure.

Difficulty Maintaining SLAs and Controls

Maintaining the Service Level Agreements- SLAs (with Customers) and Operational Level Agreements – OLAs (internally) might become difficult, especially when there will be measures and limitations on the number of employees available to handle the tasks, and the number of customers allowed to be served at the same time.

Increased Operational Risk

Banks are faced with increased operational risk when using external service providers. Even digitally, service providers may not be able to serve the banks as usual, either due to contamination which will disrupt their business or the increase in demand on their resources from their other agreements.

Increased Procurement Expenses

As a result of international lockdowns and governmental measures, the procurement expenses increased and the procurement processes might be difficult to follow. This will put an extra pressure on the Banks’ operational costs and expenses.

Unprecedented Competition

Banks are facing competition from three angles:

- Some of their typical competitors have gone through major transformations, which allowed them provide products at lower costs.

- The availability of Neo-banks, which are Digital/Mobile only for banks and provide customers with the same basic financial services.

- Companies from outside the banking sector started to offer traditional yet more innovative banking services and products.

About half of customers would consider opening an account with a digital bank

Question: would you be willing to open a new account with a new digital attacker bank with no branches developed asia?

Source: Digital Banking in the Gulf, McKinsey, 2016

Opportunities

Digital transformation is about strategy, culture and talent development. It is about employees with digital mindsets, who are rethinking business models while being agile and fast.

There is a need for developing Technology Savvy (Digital Savvy Talents) who can

- enable innovation

- scan the market for digital solutions that can be used to meet the needs of citizens

- integrate Big Data into the decision making processes

- communicate the organization’s digital purpose, needs and priorities

There is also a need to

- provide branch staff and financial brokers/advisers access to the needed data

- adjust branch hours and staff times to fit with the COVID-19 measures

- offer better customer experiences across channels

- increase the awareness of the bank’s customers

- enhance operational services

- automate simple tasks

- develop an operational risks matrix and keep track of all the risk plans

For third-party services, there is a need to

- consider the essential services

- redefine the SLAs to fit with the current challenges

- streamline procurement through a rapid sourcing process

Solutions

Big Data Solutions

Huge amounts of data about the citizens could be used to gain insights that could be integrated into decision making. Big Data Solutions, such as Hadoop and Tableau, will enhance the data quality and provide accessibility to structured and unstructured data sets, not only as texts but also as images, graphs and more.

Analytics

Analytics could be used to measure the satisfaction of the citizens and predict their future needs. Understand the root-causes of major issues of the community which would enable the decision makers to be better informed while developing new policies for the communities.

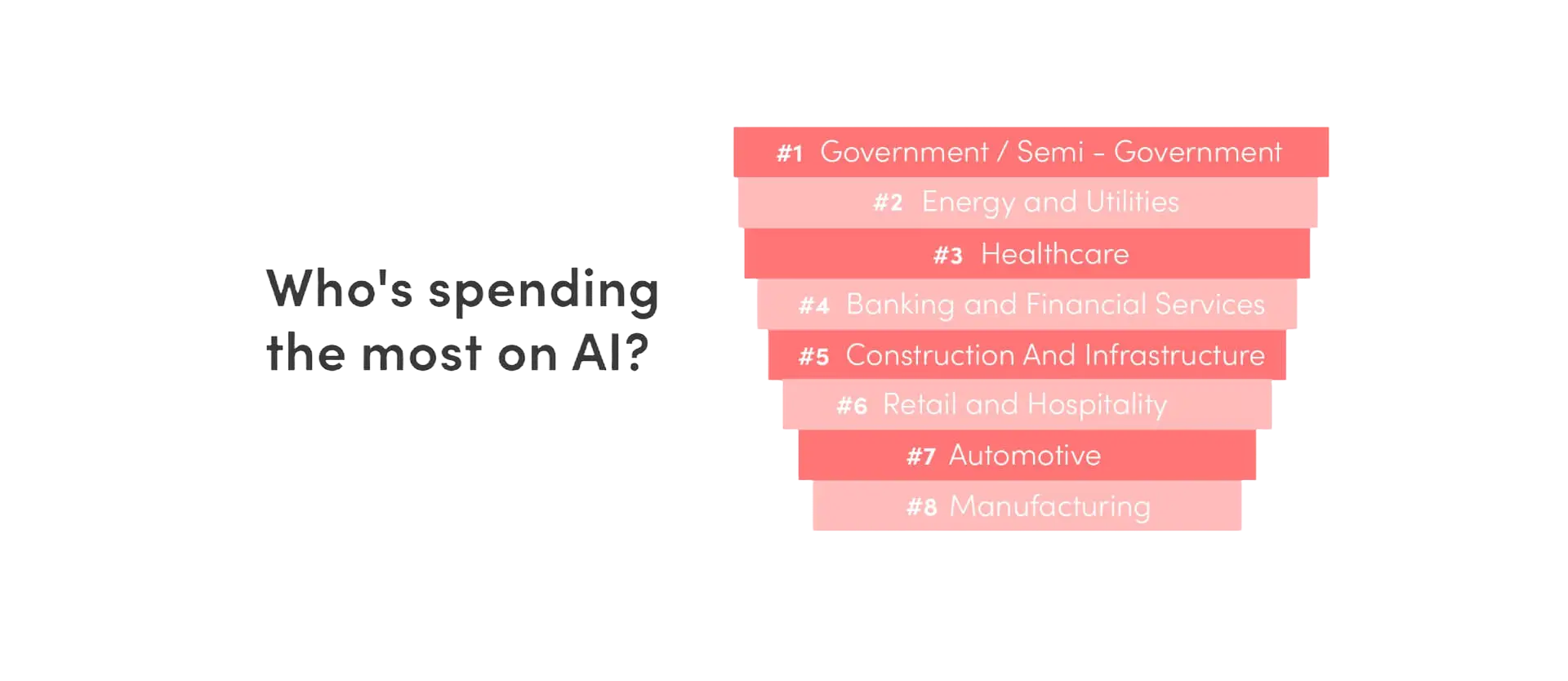

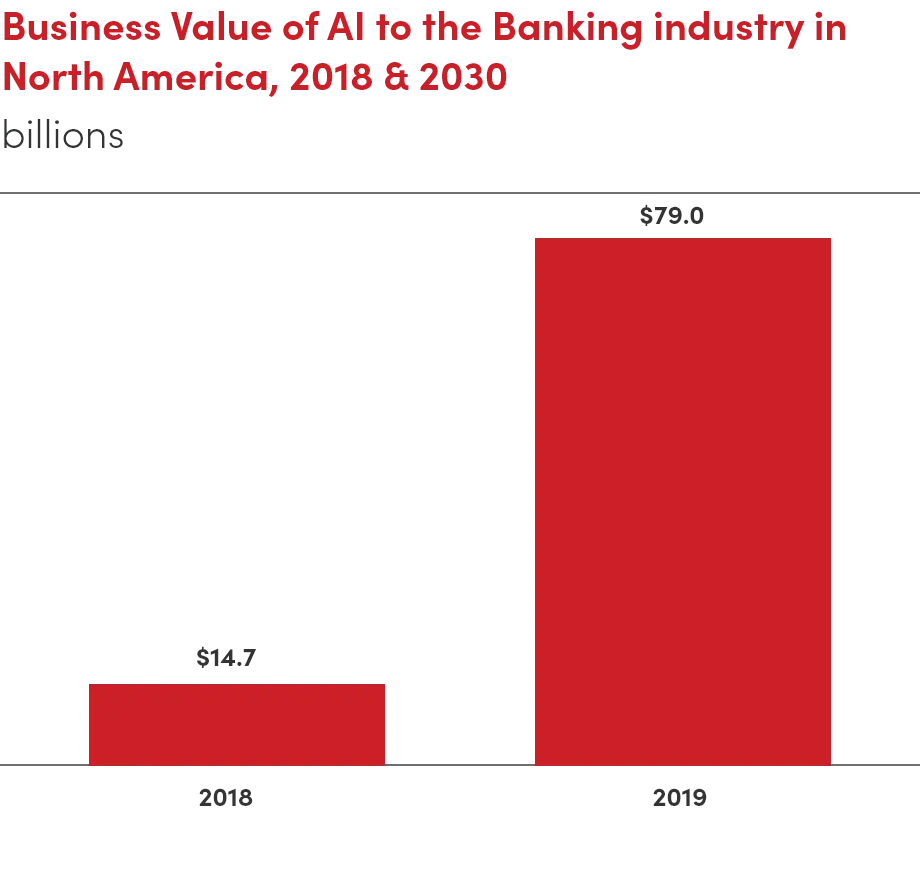

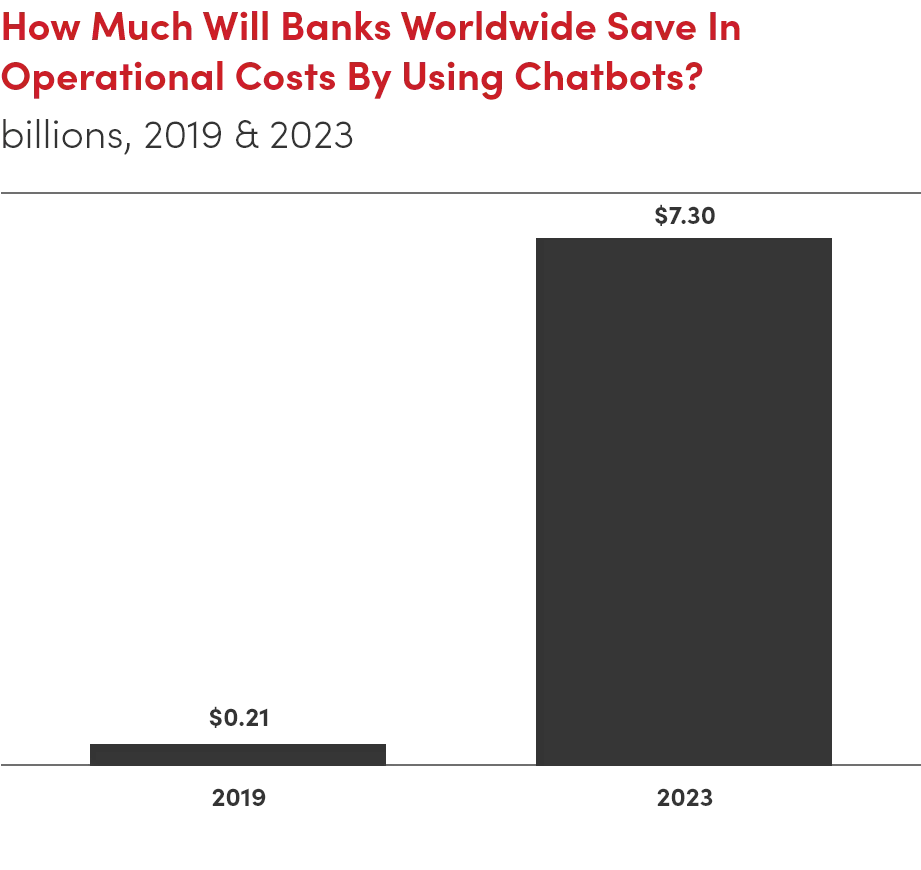

Artificial Intelligence Solutions

AI Solutions could be used to improve the business operation and enhance the customer experience via Chatbots or fraud/Risk detection features. Digital platforms could be also used to provide various channels to communicate and engage with the citizens. Cloud based technologies could be used to provide 24X7 accessibility to the databases and intelligent automation to automate tasks within the daily operations across departments.

Source: Digital Banking in the Gulf, McKinsey, 2016

Banking Sector Talents

Agile thinking is required for Banking Sector Talents to reduce the sophistication and increase the pace of development. Training in Strategic thinking is also required in order to better prioritize the initiatives within the digital agenda. Blue Ocean training would assist in enhancing the mindset and the culture to become more digitally oriented.

Benefits

As a Result of Automation and Applying Cloud Technologies There Will Be

banks will gain insights to target younger customers

banks will gain insights to target younger customers

customers will benefit from available services

customers will benefit from available services

banks will provide them with better transparency

banks will provide them with better transparencyAs a Result of AI and Chatbots Solutions

a huge reduction in IT Operational Expenses

a huge reduction in IT Operational Expenses an increase of the availability of services

an increase of the availability of services an ease of the maintenance of the IT services

an ease of the maintenance of the IT services a reduction of the need for human intervention and

a reduction of the need for human intervention and As a Result of Digital SCM There Will Be

huge enhancement in the cost transparency

huge enhancement in the cost transparency reductions of dependency on the vendors

reductions of dependency on the vendors

Source: The State of Digital Banking in 2020, Middle East Business, 2020