Banking

Implement Big Data Solutions, increase the availability and transparency of services and reduce the need of human intervention.

Introduction

Is the banking industry in the Middle East ready to overcome the challenges of the COVID-19 pandemic? The Banking sector is going through a massive transformation phase.

The Banking sector in the Middle East is one of the world’s fastest growing markets. Banks across the region are investing heavily to match or outperform their international competitors. Changes in consumer behaviors, digitization and emerging technologies has increased the complexity of the banking industry, the demand for realtime interaction and the need for better experiences across channels.

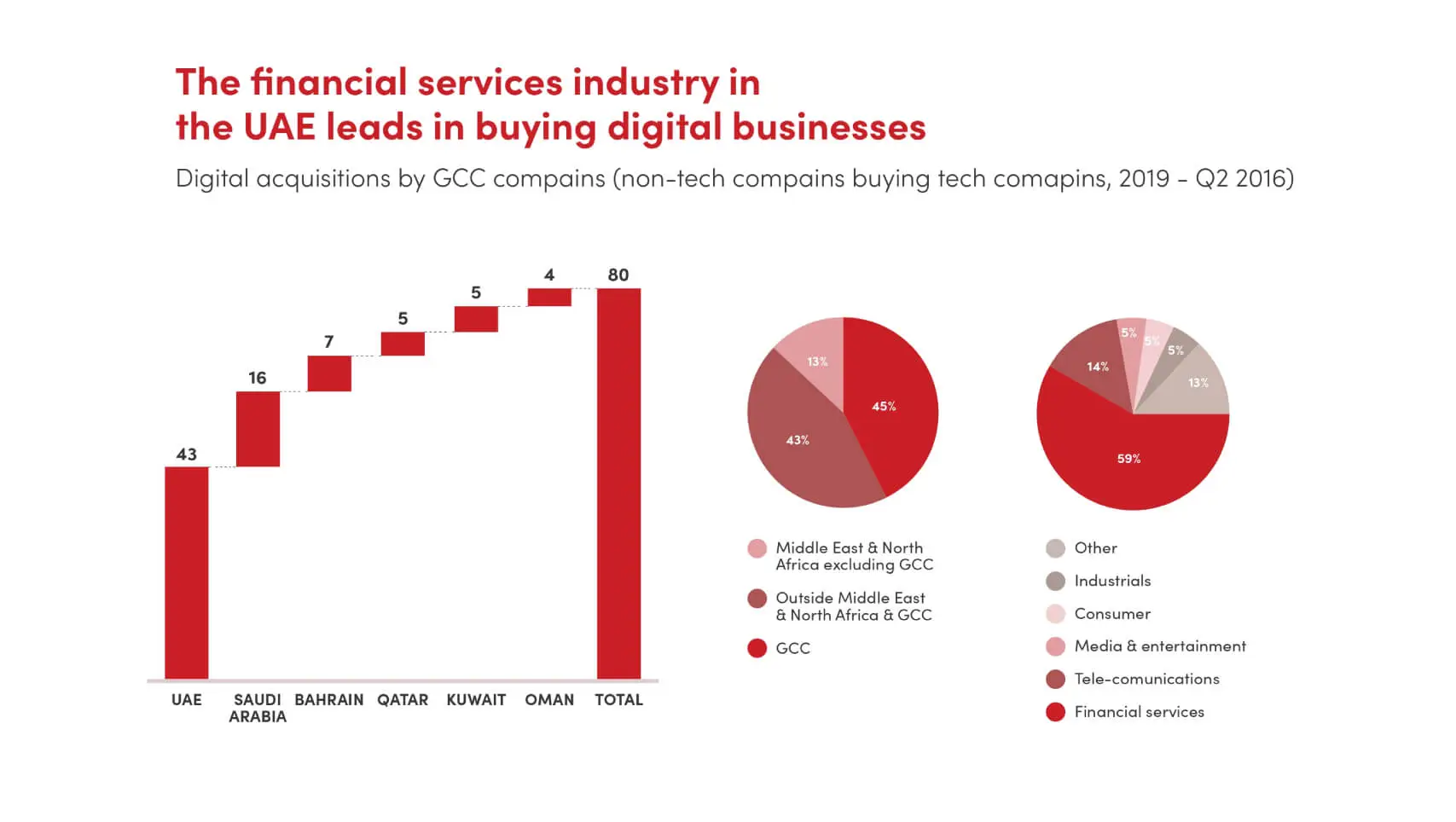

Governments in the Middle East pushed for Digital Transformation in the banking sector during services entities to acquire and invest in the technology business.

Source: Zawya Thomson Reuters; Strategy & Analysis,

From: Preparing for the digital era: The state of digitalization in GCC businesses, 2016

Key Challenges in Banking Sector

Price Transparency for Products

Unpredictable Availability of Infrastructural Recourses

Waiting Time of Call Centers

Difficulty Maintaining SLAs and Controls

Increased Operational Risk

Increased Procurement Expenses

Unprecedented Competition

- Some of their typical competitors have gone through major transformations, which allowed them provide products at lower costs.

- The availability of Neo-banks, which are Digital/Mobile only for banks and provide customers with the same basic financial services.

- Companies from outside the banking sector started to offer traditional yet more innovative banking services and products.

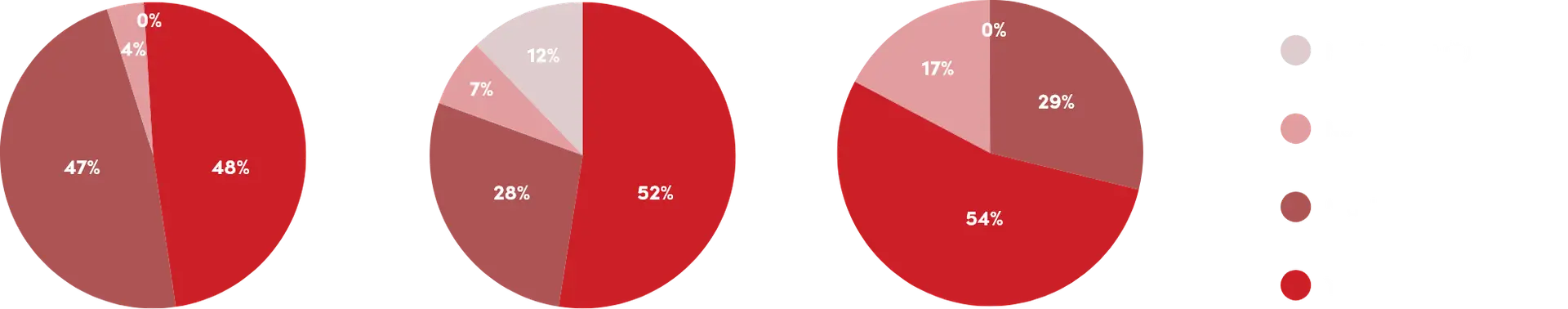

About half of customers would consider opening an account with a digital bank

Question: would you be willing to open a new account with a new digital attacker bank with no branches developed asia?

Opportunities

Digital transformation is about strategy, culture and talent development. It is about employees with digital mindsets, who are rethinking business models while being agile and fast.

There is a need for developing Technology Savvy (Digital Savvy Talents) who can

- enable innovation

- scan the market for digital solutions that can be used to meet the needs of citizens

- integrate Big Data into the decision making processes

- communicate the organization’s digital purpose, needs and priorities

There is also a need to

- provide branch staff and financial brokers/advisers access to the needed data

- adjust branch hours and staff times to fit with the COVID-19 measures

- offer better customer experiences across channels

- increase the awareness of the bank’s customers

- enhance operational services

- automate simple tasks

- develop an operational risks matrix and keep track of all the risk plans

For third-party services, there is a need to

- consider the essential services

- redefine the SLAs to fit with the current challenges

- streamline procurement through a rapid sourcing process

Solutions

Big Data Solutions

Huge amounts of data about the citizens could be used to gain insights that could be integrated into decision making. Big Data Solutions, such as Hadoop and Tableau, will enhance the data quality and provide accessibility to structured and unstructured data sets, not only as texts but also as images, graphs and more.

Analytics

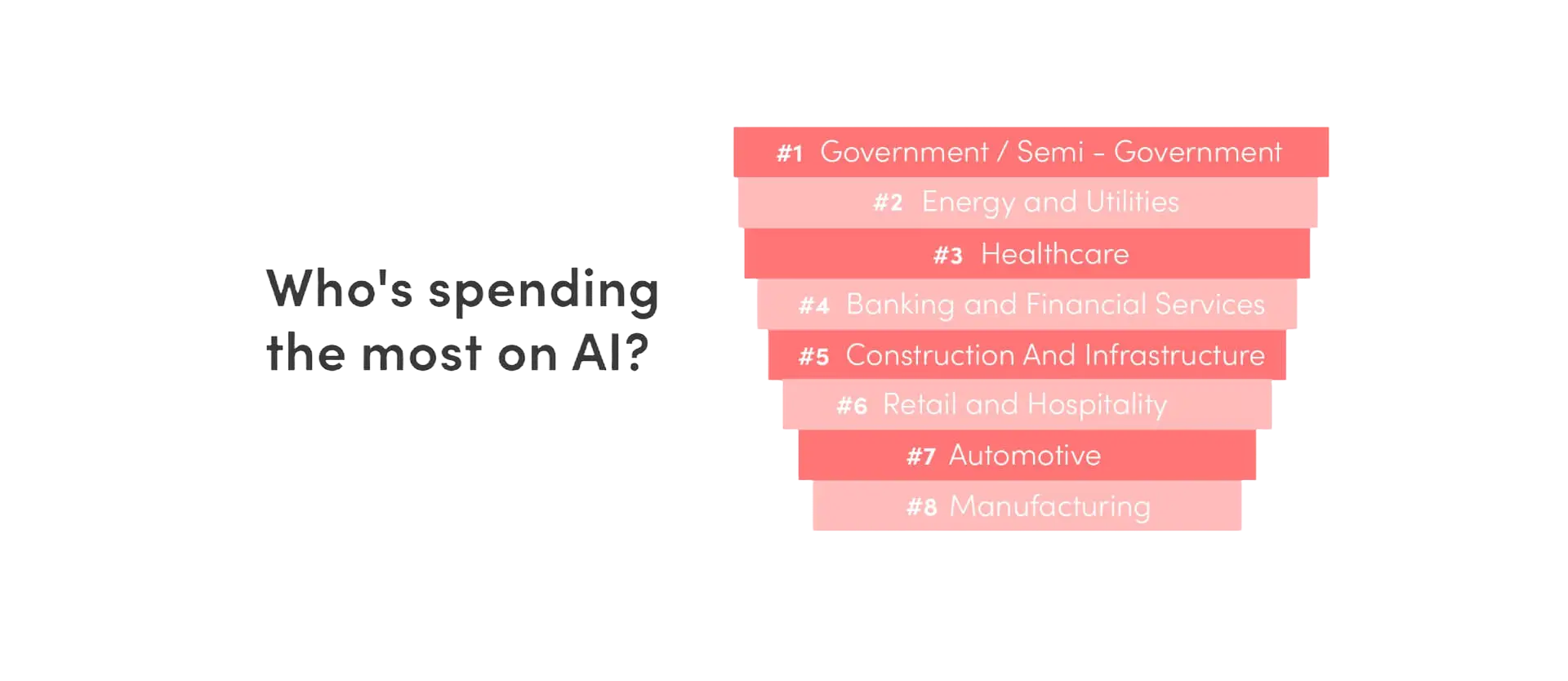

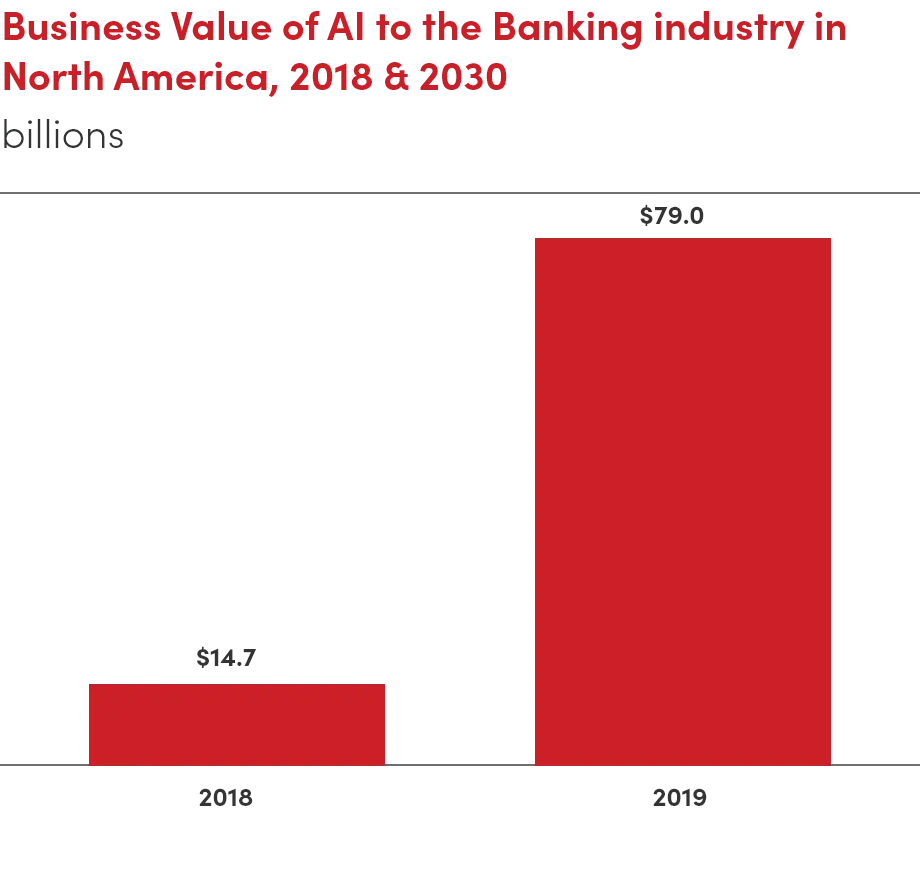

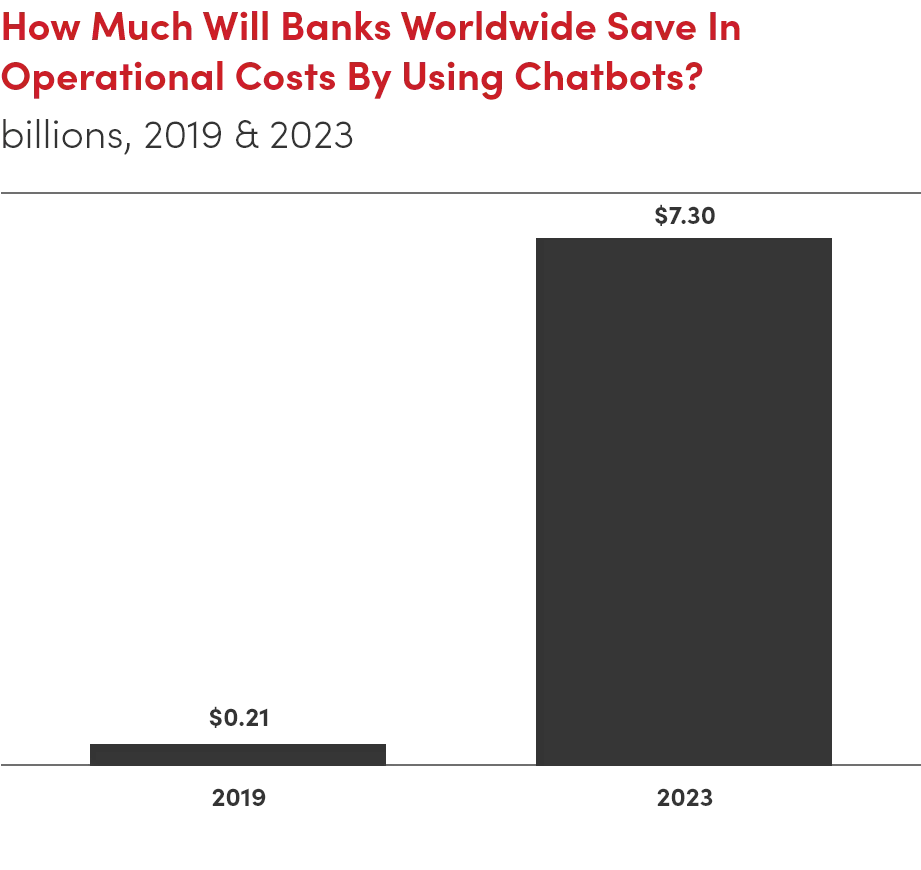

Artificial Intelligence Solutions

Banking Sector Talents

Benefits

As a Result of Automation and Applying Cloud Technologies There Will Be

banks will gain insights to target younger customers

banks will gain insights to target younger customers

customers will benefit from available services

customers will benefit from available services

banks will provide them with better transparency

banks will provide them with better transparencyAs a Result of AI and Chatbots Solutions

a huge reduction in IT Operational Expenses

a huge reduction in IT Operational Expenses an increase of the availability of services

an increase of the availability of services an ease of the maintenance of the IT services

an ease of the maintenance of the IT services a reduction of the need for human intervention and

a reduction of the need for human intervention and As a Result of Digital SCM There Will Be

huge enhancement in the cost transparency

huge enhancement in the cost transparency reductions of dependency on the vendors

reductions of dependency on the vendors

our Partners

Join our monthly VCL Value Talks — a platform where thought leaders and industry experts share how they’re overcoming challenges and reinventing value delivery in their fields.