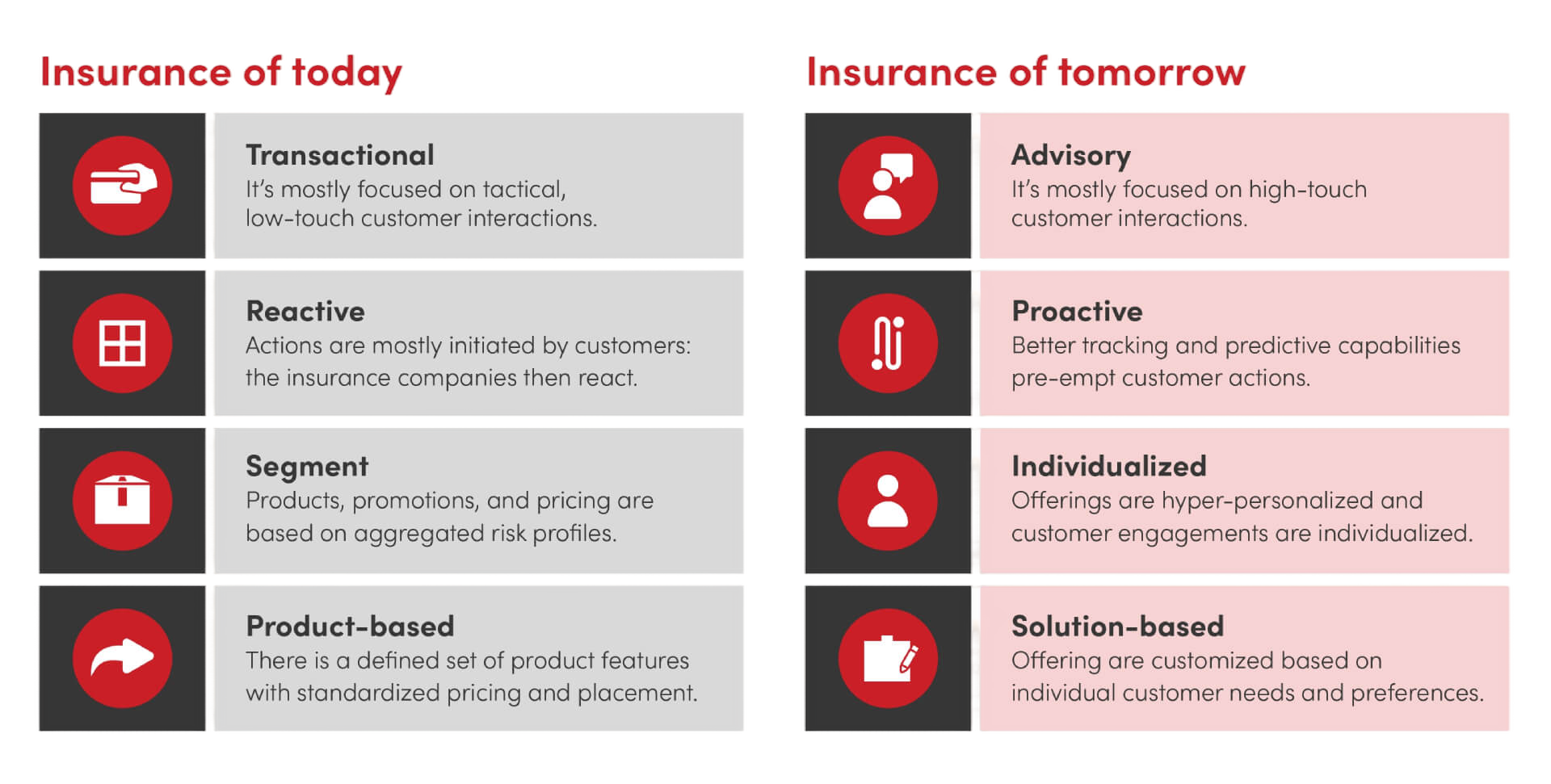

The insurance has traditionally been built on incomplete information. Subjects with similar but unknown risks are put together, and are charged with a fixed premium to cover future liabilities, based on uncertain probabilities. This has been intensified with the spread of the COVID-19, where the information is not only incomplete and uncertain but also is shifting as a result of the constantly changing governments’ measures.

Many insurance customers are under financial pressures due to job losses, income reduction or no income. They are also in more need of financial and medical support. Other customers will be opting for reducing their spending by not choosing to purchase new policies, renewing their current ones or renewing them with reduced coverage. Insurance companies under pressure to balance between achieving financial performance and providing community responsibility to the vulnerable customers.

As customers stay at home, the need for certain policies such as vehicle and travel insurance have been reduced. As many construction projects are on-hold, there is no need for construction insurance.

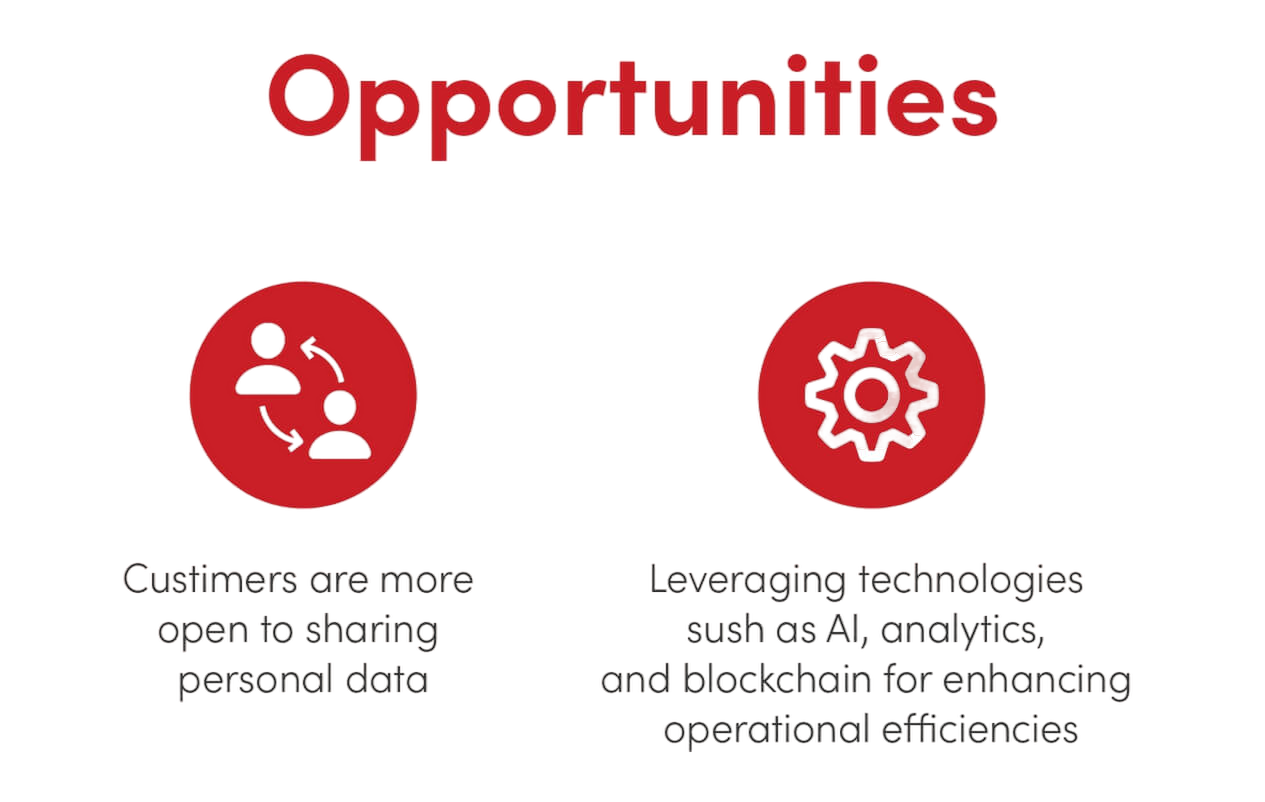

In the insurance sector, the communication is heavily paper-based and many processes are still manual. However, the need for digital solutions has been increased during the pandemic. Most of the insurers have a legacy IT infrastructure that doesn’t allow the integration of processes, which is hindering the ability of these insurers to respond to this challenge.

Many talents from insurance companies are not skilled to work in digital environments and they are put under strains to work remotely. However, they have no access to the needed information as they are not allowed to visit the physical premises.

a huge reduction in IT Operational Expenses

a huge reduction in IT Operational Expenses an increase of the availability of services

an increase of the availability of services an ease of the maintenance of the IT services

an ease of the maintenance of the IT services a reduction of the need for human intervention

a reduction of the need for human intervention![]() insurers will realize a reduction in the distribution costs

insurers will realize a reduction in the distribution costs![]() customers will be able to receive personalized service and advice

customers will be able to receive personalized service and advice![]() costs will be more optimized as the availability of more accurate data will enable the insurers to price the services and products more accurately and will result in more informed decisions which will in turn result in risk reduction

costs will be more optimized as the availability of more accurate data will enable the insurers to price the services and products more accurately and will result in more informed decisions which will in turn result in risk reduction