Customer centricity is essential if you want your company to have a competitive edge. According to a study by Gartner, 89% of businesses compete mainly on the customer experience they provide. And this is especially evident in the retail banking sector, where customer loyalty is scarce. The challenge for banks today is customers are no longer comparing their experiences within industry segments and compare their experiences to companies such as Amazon, Apple and Uber. This is why retail banks need to dedicate time, effort and money on making their customer centric slogans a reality, or they risk losing their customers.

1. Leverage advanced analytics

With the abundance of tools and technologies available for gathering customer insights such as behaviours, sentiments and feedback, banks today have no excuse to not know who their customers are and what they want. The main challenge for banks is data integration, as each channel, product, and business unit tend to work separately. Banks need to evaluate the effectiveness of their customer data collection across the organisation and implement a system to collect and analyse customer data across all channels.

It is also important that banks make sure they are collecting data that is both useful and insightful. This can be accomplished by expanding traditional data libraries to include loan to value ratio, number and age of dependents, preferred channel and educational background, in order to get insights on customers’ purchasing habits, financial needs and life stages.

With this new information in hand, banks can then strategically move away from purely transactional banking relationships, and towards highly personalised offerings and experiences. Possessing insightful data will give banks the insights needed to positively influence business decisions when it comes to pricing, new products and services, bundle offerings and more. Customer data can also drive marketing and advertising campaigns by promoting relevant messages to both current and potential clients.

Finally, customer data can be used to increase profits by predicting the future needs of the customers and thus focusing on proactive commercial activities instead of reactive ones. Proactive commercial activities include having the right product available through the right channel at exactly the right time in a customer’s life, such as for a customer’s next life event that could require a student loan, car loan or mortgage.

2. Map end-to-end customer journey across all channels

Mapping the customer journey through the customer’s perspective, is the most effective way to identify inconstancies across all customer interfaces, as well as identify potential sources of customer dissatisfaction. Banks need to map out the customer journey across all channels, not only in person but also for phone, web and mobile interactions, to improve each touch point customers will have with their bank. Powered by this knowledge, retail banks can develop practical steps to improve the customer experience, as well as ensure customers have positive experiences across all channels. To do this successfully, companies must keep the customer’s purpose in mind and not solely focus on improving technological capabilities.

The main barrier impeding the implementation of a customer-centric strategy is the silos organisational structure of banks, whereby each channel, product and business unit works in a separate department. Working in silos not only makes collecting and analysing data extra challenging, but also increases inconsistences in the customer journey and complicates cross selling efforts. Retail banks need to revise their organisational structure to move away from rewarding individual departments and implement shared-service models, cross selling metrics and customer-centric employee incentives across the organisation.

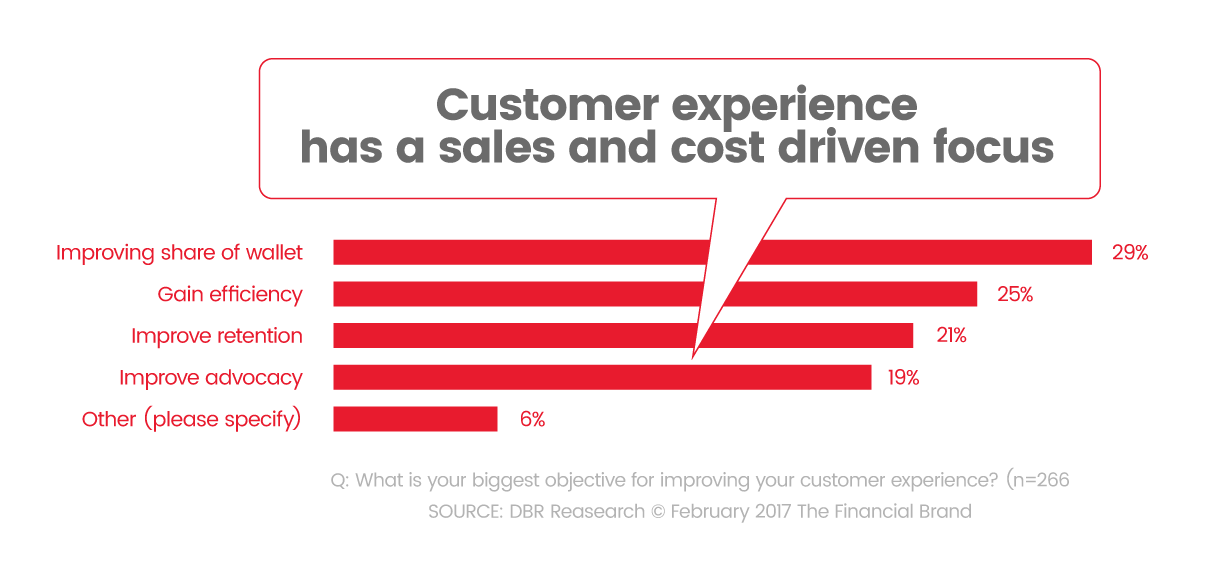

Q: What is your biggest objective for improving your customer experience? (n=266

SOURCE: DBR Reasearch © February 2017 The Financial Brand

3. Secure social media as a friend, not foe

Social media has become an undeniably important part of most of our lives, which in turn has made it an essential tool for modern businesses. With the advancements of mobile technologies and internet capabilities, social media has the ability to make or break a business. With clients now able to instantly share their satisfaction or dissatisfaction of their banking experience with both their contacts and the general public, banks should be incentivised to provide a consistently high-quality experience across all channels, as any one bad experience could affect the organisation as a whole.

Being active on social media also has the benefit of exposing retail banks to the thoughts and feelings of their clientele. In addition to proactively responding to customers’ feedback both positive and negative, banks need to implement a formal Voice of the Customer (VOC) programme across the organisation.

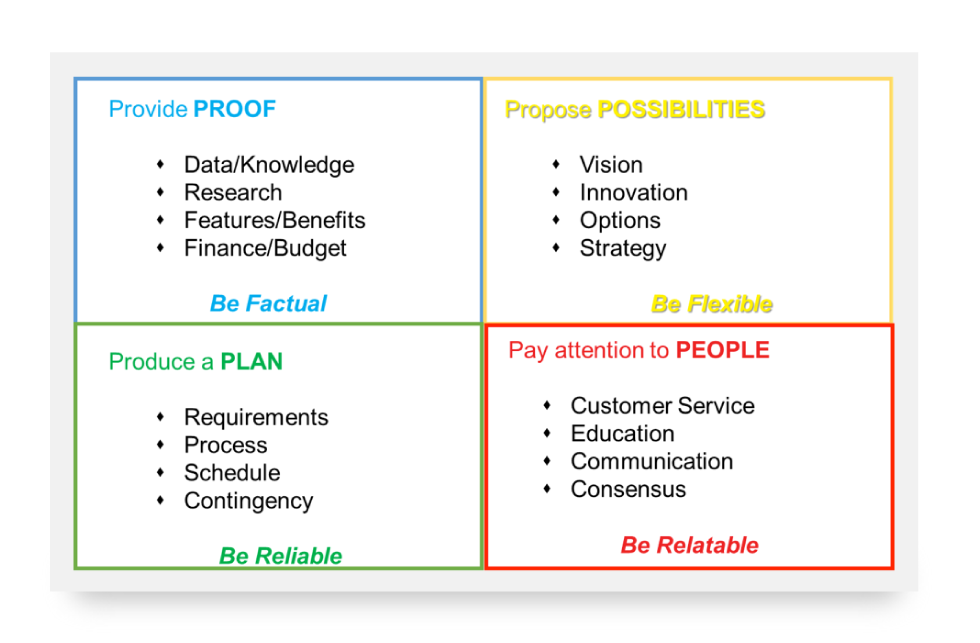

Banks can create an effective VOC programme using the Herrmann Brain Dominance

instrument (HBDI)® which is a powerful psychometric assessment that defines and describes the way people think and process information. TTM associates developed a new approach to:

• Understand how thinking preferences affect communication with customers.

• Identify customers’ thinking preferences in relation to your own preferences and the situation.

• Adapt your thinking preferences to your customers as needed.

Humans have four basis mental preferences: Rational self, Safekeeping self, Feeling self and Experimental self. While these are interconnected, generally people naturally and habitually think more dominantly with one or two, over the others. The ideal VOC should be based on developing messages that resonates with all four thinking preferences, as this would have the widest appeal.

4. Innovate to get ahead

When it comes to creativity and innovation, the banking sector often lags behind many other industries, which is why innovative services and products are guaranteed to give banks a competitive edge. In 2016, HSBC and the Bank of Montreal partnered with MasterCard were the first banks to use facial recognition technology to open an account and to make payments online. To promote the new service, they used trendy marketing campaigns with slogans such as, “Selfie Payment Technology”, “Need A Bank Account? Take A Selfie” and “Selfie Verification”. This year many banks have followed in their footsteps and have adopted this technology.

Another innovative product that is gaining traction worldwide in the banking industry is ‘Cardless Cash.’ Cardless Cash allows customers to withdraw money from an ATM using their smartphone instead of a debit card, as well as send money to others by providing them a code to retrieve money from ATMs. This service and technology is convenience at its finest, which all retails banks can learn from.

Final Thoughts

Now more than ever, it is crucial for retail banks to focus on their customers’ present and future needs. This entails adopting new technologies, organisational restructuring, revised employee reward and incentive policies, and innovative products and services. Collecting and using customer advanced analytics is the most effective way banks can provide the personalised experience customers now expect. Moreover, banks can use their social media presence and a comprehensive VOC programme as a competitive differentiator.