In the face of intense competition in the pharmaceutical industry, with sales reaching their peak and the market becoming saturated, it is very difficult for companies to maintain their profits, let alone continue seeking to increase them. Pharmaceutical product life cycle management strategies can no longer focus solely on the period from launch to patent expiration. Successful drug manufacturers now include the entire lifecycle, from discovery through end of life.

Products passing into the maturity stage, the third stage of the product life cycle after the introduction and growth stages, can be quite challenging for manufacturers. In the first two stages companies try to establish a market and then grow sales of their product to achieve as large a share market as possible. However, during the maturity stage, the primary focus for most companies will be maintaining their market share in the face of a number of different challenges, such as sales volumes peak, the decreasing market share and profits declining.

In the case of pharmaceutical companies, as patent expiry emerges, branded drugs can no longer only focus on extending product lives, they need defensive strategies to combat their generics competitors actively and retain market share.

Product Life Cycle Management

To develop more comprehensive life cycle management strategies many pharmaceutical companies have found that input from many different business groups must be considered. A cross-functional life cycle management team that includes representatives from marketing, R&D, manufacturing, process engineering, regulatory and other groups across all therapeutic areas can establish an overall company-wide strategy as well as product-focused strategies that leverage past experience across the entire product portfolio.

Such a holistic or integrated approach can result in the identification of new markets and new technologies for extending the lifetime of small-molecule drug products. This strategy often includes planning for generics competition early in the development phase, rather than after a product is launched. Many companies file multiple patents based on different compositions of matter, methods, formulations, etc. to create multiple expiration dates in different geographic markets.

Drug Life Optimization

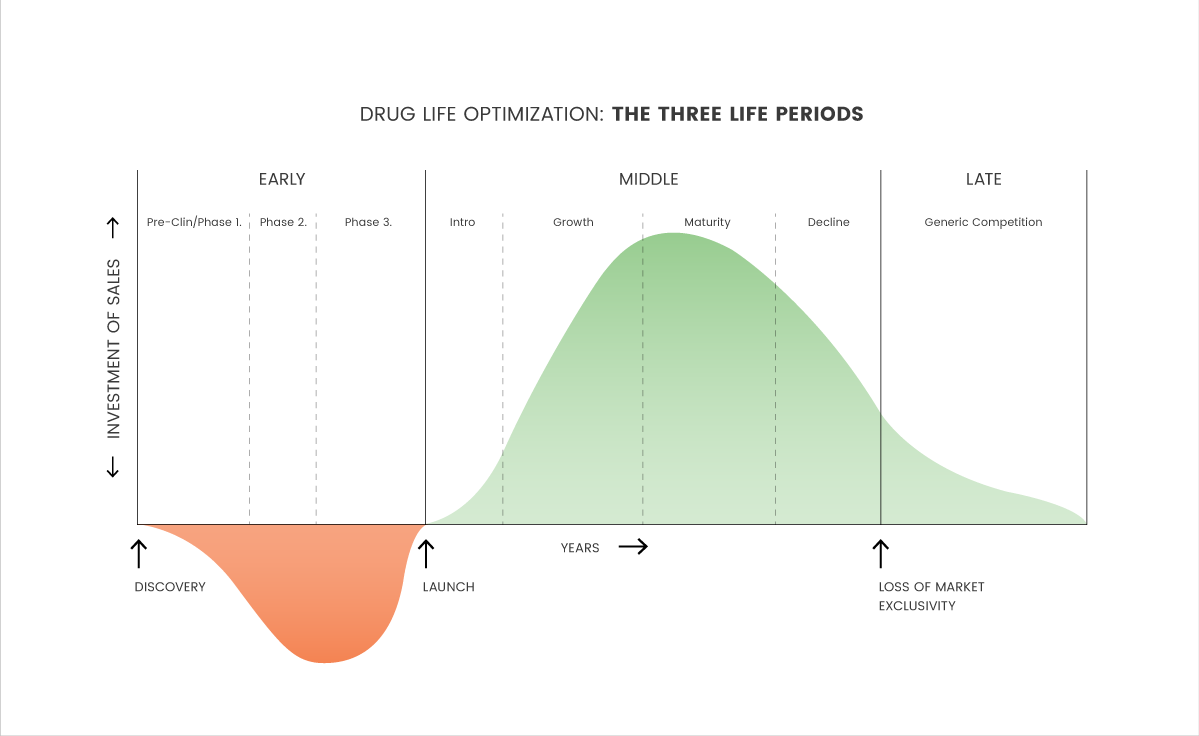

Applying the limited LCM approach to pharmaceutical products however, can sometimes lead to flawed assumptions, unrealistic strategies and value-destroying execution. Pharmaceutical professionals are advised instead to consider the concept of Drug Life Optimization, which enables pharmaceutical professionals to view the entire

life—not just the lifecycle—of a product in order to make more appropriate, timely and strategic decisions through each of a product’s three life periods. Unlike most products, drugs are unique products which have not one lifecycle but rather three different life periods:

a) An extensive early development period

b) A highly competitive mid-life period

c) A significant late post-patent period

These three periods together constitute the real life of a drug, running from bench to bedside (figure below). Drugs have a lengthy, closely regulated and complex developmental pre-marketing phase usually lasting a decade or longer. During this period of scale up toward commercialization, drugs are influenced by an extremely diverse group of customers and stakeholders, each of which can dramatically alter the conditions of access, utilization, pricing and sales.

In a report titled “Combating Generics: Pharmaceutical Brand Defence by Cutting Edge”, it examines a variety of these strategies, including five basic principles for success in planning and for generic competition:

– Protect existing brands from patent challenges and generic competition through litigation.

– Switch patients to next-generation drugs to balance existing brand defence strategies,

a market practice known as evergreening.

– Assimilate public, political and regulatory changes into generic planning.

– Initiate generic defence planning earlier and support it with necessary resources.

– Explore licensing, deal-making and market-crossover strategies as viable solutions to generic competition, a strategy known as flanking.

Case Study

AstraZeneca’s next generation Prilosec (Omeprazole) to Nexium (Esmeprazole) switch is an industry paradigm. Omeprazole and esomeprazole are nearly identical on a chemical level, with the same side effects and drug interactions, AstraZeneca submitted Nexium to the FDA early enough and managed to convince the US Patent Office that Nexium was substantially different from Prilosec and thus should be granted its own patent, along with 20 years of protection, transferring 40 per cent of Prilosec patients to Nexium in 2001.

While some claim Nexium should have never been approved in the first place, many have addressed the Prilosec- Nexium chiral switch as ideal, including Agranat, Caner, and Caldwell, who wrote in their review: “When the chiral switch is developed by the proprietor of the racemate, it is advantageous for the single enantiomer to reach the market before the expirations of the patents of the racemates, and before the incursion of the respective generic drugs.”

Nevertheless, the “purple pill” marketing plan was brilliant! When the FDA approval came through, one of the most massive marketing campaigns in US history began. The company spent $500m on direct-to consumer marketing, hospital discounts on the drug, free samples for doctors’ offices and media advertising. Its marketing efforts resulted in an abundance of patients transferring to the next-generation product with the new patent, thus preventing the ability of the generic to capture a large portion of AstraZeneca’s share of the gastrointestinal market.

Astra- Zeneca also switched Prilosec to an OTC drug as its prescriptions dropped. It made AstraZeneca almost $48 billion during the past decade, without any innovation or benefit to people who had previously been taking Prilosec to control their heartburn. The strategy behind Nexium is called ‘patent extension’—a strategy to increase the amount of time during which the company that made the initial discovery has a “monopoly” on a particular drug.

Final Thoughts

In today’s highly competitive and constantly changing pharmaceutical market, branded drug owners are increasingly committed to the development of integrated life cycle management strategies in order to realize the maximum revenues from each product in their portfolio and ensure their continued ability to find new treatments that will bring real benefits to more patients. Life cycles will differ from product to product, and market to market.

At the same time, an increase in sales isn’t always an indication that the market is growing, just as a fall in sales doesn’t necessarily mean a market is in decline. It is important to appreciate products have a limited lifetime and acknowledge the different stages of the product life cycle. However, fighting aggressive generic competition and retaining a greater percentage of the sales generated in the post-patent-expiry period, successful leaders don’t allow this model to be the sole source of information that dictates their business strategy.